by Gary Sands

A two-day summit to unveil what China is portraying as the infrastructure project of the century concluded on May 15. The $1 trillion initiative is designed to vastly expand free trade in Africa, Asia and Europe. Realization of the plan will depend in part on the effectiveness of a newly minted development mechanism, known as the Asian Infrastructure Investment Bank (AIIB).

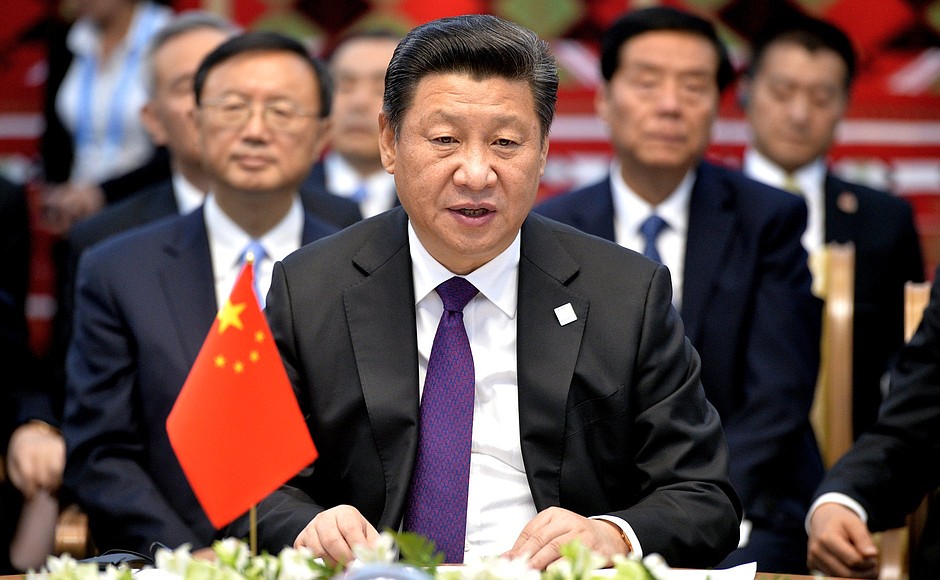

The summit, held outside the Chinese capital Beijing, celebrated the launch of China’s Belt and Road infrastructure vision. It brought together 30 world leaders, including Chinese President Xi Jinping, who expressed hope the project would promote growth and a new world order.

“It is our hope that via the Belt and Road initiative, we will unleash new economic forces for global growth, build new platforms for global development, and rebalance economic globalization,” Xi told summit attendees on May 15.

The financing needed to realize Belt and Road plans presents lots of challenges. Beijing will be looking to the AIIB, which began operations only in January 2016, to be a Belt and Road catalyst, including providing financing for projects in Central Asia.

Fifty-seven states are participating in the AIIB. China is the largest provider of start-up capital for the bank, injecting almost $30 billion, or roughly 32 percent of the bank’s overall funds. Beijing also controls almost 28 percent of the bank’s voting shares. Other major donors include India, which controls 8 percent of voting shares, and Russia, which has a 6 percent stake.

The United States and European Union have not joined the AIIB, but are closely monitoring its development. American and European finance officials have voiced concerns about potential overlap with existing institutions, including the World Bank, International Finance Corporation (IFC), European Bank for Reconstruction and Development (EBRD) and Asian Development Bank (ADB). Western officials have also wondered publicly whether the AIIB will adopt best practices in such areas as transparent procurement, environmental and social safeguards, and good governance.

Regional experts believe the reluctance of the United States, EU and others to give Beijing more of a say in the operations of existing financial institutions was a significant factor in prompting China to push for the creation of the AIIB.

The AIIB’s stated aims are to invest in and attract other long-term financing for transportation, telecom and energy projects throughout Asia. To date, the AIIB has approved loans worth US$1.73 billion to support 13 projects in eight countries, including the former Soviet states of Azerbaijan and Tajikistan.

Tajikistan stands to benefit from a project to improve roads, including a route connecting Tajikistan and neighboring Uzbekistan. In June 2016, the AIIB approved a direct loan for $27.5 million, alongside $62.5 million from the EBRD, for an upgrade of a key 5-kilometer section of the motorway.

Beijing also shares a border with Tajikistan, and has in recent years extended credits to Dushanbe for roads, tunnels and power infrastructure. The AIIB-financed highway project stands to improve China’s access to Central Asian markets, allowing for a freer flow of Chinese-made goods and products.

The AIIB’s participation in the overall financing is small, a factor that will limit any geopolitical influence from Beijing. Nonetheless, the project could create a template for further road and highway projects throughout the region.

In Azerbaijan, the AIIB has invested $600 million in the $8.6 billion Trans-Anatolian Natural Gas Pipeline (TANAP) project, a key component in the Southern Gas Corridor. Once complete, the pipeline is expected to transport natural gas extracted from the Shah Deniz 2 field across Turkey and on to Europe, thus improving “the energy supply security of Turkey and South Eastern Europe.”

While China will not benefit directly from TANAP, the project could again create a blueprint for project financing and implementation that could be replicated for future initiatives involving pipeline construction to connect the Caspian Basin to China.

With its proposed capitalization of $100 billion, and an initial target of $4-5 billion in annual lending, the AIIB is a relatively small player in comparison to China’s largest policy lenders, China Development Bank and the Export-Import Bank of China. Nevertheless, the AIIB has an important role to play in the Belt and Road project. Beijing is keen to gain geopolitical and geoeconomic influence through the creation of additional institutions, including the AIIB, the New Development Bank and the Silk Road Fund.

” Western officials have also wondered publicly whether the AIIB will adopt best practices in such areas as transparent procurement, environmental and social safeguards, and good governance.” LOL!!!!! And the IMF and its terrible toll of environmental damage in so many countries, pretends to care!

If the USA and NATO spent money on useful projects, not warmaking and threats and bases, what a great difference, a positive one, would we see. China has the sense of the future and hope for improvements, not destruction. JOIN them all, Westerners!!!

The scale of the project is visionary, although its benefits to China not clear at the moment. Broad participation in the project also bodes well for its future. European and north American Multi-nationals seem reluctant to invest in Asian and African countries and these states desperately need capital investment. Too bad US and Europe have not joined the initiative and not having a stake in the venture they won’t be influence the practices and outcomes in positive manner. Even a small investment would have been good. There is cultural aspect to this export-development project. For example teaching of Chinese in these countries.

A number of inaccuracies have crept into this report all reported at the time through the FINANCIAL TIMES & ,the NEW YORK TIMES & REUTERS & also here at LOBELOG by Jim Lobe himself including:

i)While it is true the EU itself has not joined the AIIB that is only because the invitation to become a Prospective Founding Member was only extended to nation-States who are recognized at the UN level–indeed with London’s quite public rejection of Washington’s “blockade” of the proposed AIIB in March 2015 the 57 members of the AIIB include some 20 members countries who are not in Asia some of which are/where in the EU.

Jim Lobe reported at this website on the abandonment by the rest of the world on Washington’s “power-play” 21 March 2015 “Washington Misses Bigger Picture of New Chinese Bank”

ii) The New York Times report of Dec 4,2015 ” China Creates a World Bank of Its Own, and the U.S. Balks ” includes the following text:

“The bank adopted an Australian idea that procurement should not be limited to member countries, a pledge that would distinguish the bank from the existing institutions. That means companies in the United States and Japan can compete for contracts.

Staff members could also be hired from nonparticipant countries. Two American veterans of the World Bank are working with the new bank: Stephen F. Lintner, a former senior adviser on quality assurance, and Natalie Lichtenstein, who recently retired as assistant general counsel”

.

iii)Finally the AIIB commits,when working with the other multi-national lending institutions, to use their quality standards–as shown in the 2016 list of projects jointly-financed

All in all a different picture from “the USA & EU rightly look down on the AIIB efforts to not bother with Washington’s standards” portrayed here.

It is certainly better to build than to bomb.